On December 22, 2023, the Department of the Treasury and the Internal Revenue Service (IRS) released a notice of proposed rulemaking and notice of public hearing containing proposed regulations (Proposed Regulations) with respect to Internal Revenue Code of 1986, as amended (the Code), Section 45V, Credit for Production of Clean Hydrogen and Code Section 48(a)(15), Election to Treat Clean Hydrogen Production Facilities as Energy Property. The long-awaited Proposed Regulations provide critical guidance with respect to qualification for, and implementation of, the credits under Code Sections 45V and 48(a)(15). Taxpayers may rely on the Proposed Regulations for taxable years beginning after December 31, 2022, and before the date the final regulations are published, provided that taxpayers follow the Proposed Regulations in their entirety and in a consistent manner.

Overview of Code Section 45V

Code Section 45V, enacted as part of the Inflation Reduction Act of 2022, provided a general framework for credits for the production of clean hydrogen (45V Credits). Generally, 45V Credits are computed as the product of the kilograms of qualified clean hydrogen produced by a taxpayer at a qualified clean hydrogen production facility during the taxable year and the applicable rate. The applicable rate generally is the product of $3.00 if the prevailing wage and apprenticeship requirements are met (or $0.60 if such requirements are not met), as adjusted for inflation, and a percentage based upon the lifecycle greenhouse gas (GHG) emissions rate of the hydrogen produced, as follows:

Kilograms of CO2e per Kilogram of Hydrogen | Applicable Percentage |

Not greater than 4 and not less than 2.5 | 20 percent |

Less than 2.5 and not less than 1.5 | 25 percent |

Less than 1.5 and not less than .45 | 33.4 percent |

Less than .45 | 100 percent |

45V Credits are available for ten years beginning on the date the qualified clean hydrogen production facility is placed in service. No 45V Credits may be claimed with respect to any qualified clean hydrogen produced at a facility which includes carbon capture equipment for which a credit is claimed for carbon sequestration under Code Section 45Q (45Q Credits) for the taxable year or any prior taxable year.

Guidance on Determining the Lifecycle GHG Emission Rate

Code Section 45V provides that lifecycle GHG emissions have the meaning given to such term in Section 211(o)(1) of the Clean Air Act and includes the emissions through the point of production (well-to-gate) as determined under the most recent Greenhouse gases, Regulated Emissions, and Energy use in Transportation Model (GREET Model). The Proposed Regulations provide that well-to-gate emissions means the aggregate lifecycle GHG emissions related the hydrogen produced at the hydrogen production facility during the taxable year through the point of production. It includes emissions associated with feedstock growth, gathering, extraction, processing and delivery to a hydrogen production facility. Further, the Proposed Regulations state that the most recent GREET Model is the latest version of 45VH2-GREET developed by the Argonne National Laboratory that is publicly available on the first day of the taxable year during which the relevant hydrogen is produced.

The Proposed Regulations clarify that the lifecycle GHG emissions rate is determined following the end of the taxable year, taking into account all of the hydrogen produced during the relevant taxable year at a facility. The taxpayer determines the lifecycle GHG emissions rate by entering information about its production facility requested within the interface of 45VH2-GREET for the relevant hydrogen production pathway. 45VH2-GREET currently includes eight hydrogen production pathways (e.g., steam methane reforming of natural gas with potential carbon capture and sequestration, low-temperature and high-temperature water electrolysis using electricity).

If the lifecycle GHG emissions rate of the hydrogen produced at a facility has not been determined by 45VH2-GREET because the pathway is not included in the current model, then the taxpayer may use a provisional emissions rate (PER) as determined by the Secretary of Treasury. A taxpayer may not use the PER process if its feedstock and hydrogen production technology are represented in 45VH2-GREET, even if the taxpayer disagrees with the underlying assumptions or calculation approach used by the most recent 45VH2-GREET. Under the Proposed Regulations, a taxpayer petitions the Secretary for a PER by attaching a PER petition to its federal income tax return for the first taxable year of hydrogen production for which the taxpayer claims the 45V Credit including the emissions value obtained from the Department of Energy (DOE). Such DOE emissions value is obtained by submitting a request following procedures to be provided by the DOE. The emissions value request process will open on April 1, 2024. An emissions value may be requested from the DOE only after a front-end engineering and design (FEED) study or similar indication of project maturity has been completed for the facility. Taxpayers may use the PER determined by the Secretary to calculate the 45V Credits available with respect to the facility until the lifecycle GHG emissions rate of such hydrogen has been determined under the most recent GREET model.

Finally, the Proposed Regulations include a process for taxpayers to utilize energy attribute certificates (EACs) for documenting purchased electricity inputs and assessing emissions impacts of electricity used in the production of hydrogen for purposes of the 45V Credits for electrolytic hydrogen production, or as a reasonable methodological proxy for indirect emissions associated with electricity. Taxpayers utilizing the most recent GREET model or PER can only reflect the use of electricity as from a specific electric generating facility rather than a regional electricity grid if the taxpayer acquires and retires a qualifying EAC for each unit of electricity that the taxpayer claims from the source. Acquisitions and retirements of EACs must be recorded in a qualified EAC registry or accounting system.

A taxpayer may rely on an EAC only if it meets the requirements of (i) incrementality, (ii) temporal matching and (iii) deliverability. The requirements must be met regardless of whether the electricity generating facility giving rise to the EAC is grid connected, directly connected or co-located with the hydrogen production facility.

The incrementality requirement is met if the electricity generating facility that produced the electricity has a commercial operation date or increase in rated nameplate capacity no more than 36 months before the relevant hydrogen production facility was placed in service. The Treasury Department and IRS seek comments on whether to treat EACs from an existing electricity generating facility as satisfying incrementality if the facility is likely to avoid retirement because of its relationship to a hydrogen production facility, or if it is demonstrated that such sources and circumstances would not give rise to significant induced grid emissions.

Under the Proposed Regulations, the temporal matching requirement is met if the electricity represented by the EAC is generated in the same hour as the taxpayer’s hydrogen production facility uses electricity to produce hydrogen. A transition rule, which is available for EACs that represent electricity generated before January 1, 2028, allows electricity to be treated as generated in the same hour as used by the hydrogen production facility if the electricity represented by the EAC is generated in the same calendar year that the taxpayer’s hydrogen production facility uses electricity to produce hydrogen. Such transition rule is intended to permit the EAC market to develop the hourly tracking capability necessary to verify compliance.

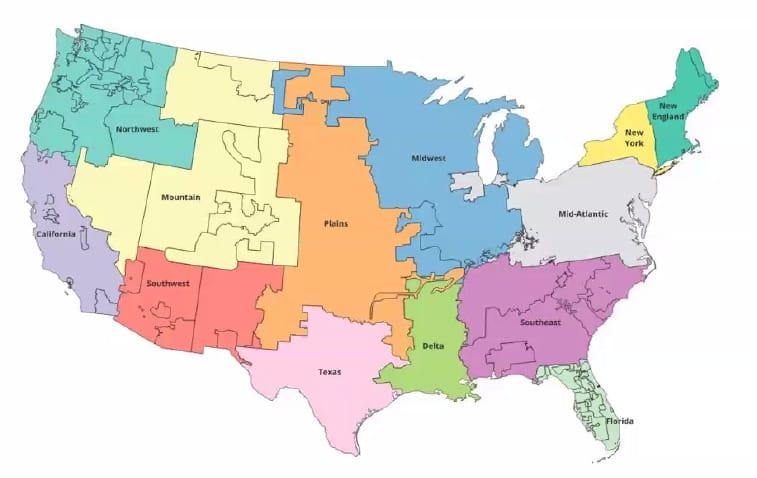

Finally, the deliverability requirement is satisfied if electricity represented by the EAC is generated by a facility in the same region as the hydrogen production facility, illustrated below.

Additional 45V Credit Guidance

Scope of the Qualified Clean Hydrogen Production Facility

For purposes of determining whether the hydrogen that is produced is qualified clean hydrogen produced at a qualified facility, “facility” is defined in the Proposed Regulations as a single production line that is used to produce qualified clean hydrogen. A single production line includes all components of property that function interdependently to produce qualified clean hydrogen. The “facility” does not include equipment to condition or transport the hydrogen after it is produced or electricity production equipment, including any carbon capture equipment associated with electricity production.

Coordination With Credits for Carbon Sequestration

Such definition of “facility” as limited to the hydrogen production line, and excluding related power generation equipment, also informs the scope of the limitation on stacking both 45Q Credits and 45V Credits with respect to the same facility. The Proposed Regulations would permit 45Q Credits to be claimed with respect to the electricity generation facility even if 45V Credits were claimed with respect to the hydrogen production facility to which the electricity is provided. Further, the Proposed Regulations provide that if a hydrogen production facility includes carbon capture equipment, and such carbon capture equipment was rebuilt so that it qualified as new equipment with a new placed in service date under the Treasury Regulations under Code Section 45Q, and no 45Q Credits were claimed with respect to the reconstructed equipment, then the owner of the hydrogen production facility may claim 45V Credits even if 45Q Credits were previously claimed with respect to the carbon capture equipment prior to its reconstruction.

Denial of 45V Credits for the Production of Waste Hydrogen

Under the Proposed Regulations, 45V Credits are not available if the primary purpose of the production and sale or use of qualified clean hydrogen is to obtain the benefit of 45V Credits in a manner that is wasteful. Examples of wasteful production include the production of clean hydrogen that the taxpayer knows, or has reason to know, will be vented or flared.

Modified or Retrofitted Hydrogen Production Facilities

In the case of a facility that was originally placed in service before 2023, and, prior to modification, did not produce qualified clean hydrogen, which is modified to produce qualified clean hydrogen, and the costs incurred are properly chargeable to the taxpayer’s capital account, the facility will be deemed to have been originally placed in service as of the date the property required to complete the modification is placed in service.

In addition, a new placed-in-service date can be established for an existing facility if it is refurbished and the fair market value of the used portion of the facility is not more than 20 percent of the fair market value of the entire facility (80/20 Test). If the 80/20 Test is satisfied, then, for purposes of Code Section 45V, the placed-in-service date for the facility would be the date the new property added to the facility is placed in service. The 80/20 Test applies to any existing facility, regardless of whether the facility previously produced qualified clean hydrogen.

Procedures for Verification of Qualified Clean Hydrogen Production and Sale or Use

A verification report must be attached to the taxpayer’s Form 7210, Clean Hydrogen Production Credit and included with the taxpayer’s federal income tax return or information return for each facility and each year in which 45V Credits are claimed. Such form must be prepared by a qualified verifier under penalties of perjury. A qualified verifier generally means any individual or organization with active accreditation as a validation and verification body from the American National Standards Institute National Accreditation Board or as a verifier, lead verifier or verification body under the California Air Resources Board Low Carbon Fuel Standard program.

The qualified verifier must confirm the amount of hydrogen produced at the facility and that the operation of the facility is consistent with the information provided for purposes of the GREET analysis or the PER petition, including purchases of EACs. The qualified verifier also must confirm the appropriate sale or use of the hydrogen produced.

Code Section 48(a)(15) and Related Proposed Regulations

Code Section 48(a)(15) allows a taxpayer that owns a clean hydrogen production facility to claim an investment tax credit (48 Credit) in lieu of 45V Credits through an irrevocable election (Investment Credit Election) for any qualified property that is part of the facility. The 48 Credit rate generally ranges from 6 to 30 percent if the prevailing wage and apprenticeship requirements are met (or 1.2 to 6 percent if such requirements are not met) based upon the kilograms of CO2e per kilogram of hydrogen categories under Code Section 45V the hydrogen production facility is designed and reasonably expected to produce. Under the Proposed Regulations, if the facility is owned by a partnership or an S-corporation, the Investment Credit Election would be made by the partnership or S-corporation and would be binding on all ultimate credit claimants. Further, if the facility is jointly owned, and any taxpayer makes the Investment Credit Election with respect to the facility, then that election would be binding on all taxpayers that directly or indirectly own an interest in the facility.

Under the Proposed Regulations, if the Investment Credit Election is made, the taxpayer must obtain and submit an annual verification report signed by a qualified verifier for the taxable year for which the election is made and each taxable year of the recapture period attesting to the lifecycle GHG emissions rate of the hydrogen produced. The recapture period begins on the first day of the taxable year after the year in which the hydrogen production facility was placed in service and ends on the last day of the fifth taxable year after the close of the taxable year in which the facility was placed in service. If the taxpayer fails to obtain an annual verification report on a timely basis or the lifecycle GHG emissions rate is greater than the rate used to determine the 48 Credit and would have resulted in a lower 48 Credit rate, in any taxable year during the recapture period, a recapture event will occur. As a result of such recapture event, the taxpayer would incur an additional tax liability for such taxable year equal to 20 percent of the excess of the 48 Credit allowed over the 48 Credit that would have been allowed if the taxpayer had used the credit rate supported by the actual hydrogen production. The 48 Credit that would have been allowed is deemed to be zero if the taxpayer fails to obtain the annual verification report.

Comments and Public Hearing on the Proposed Regulations

Before the Proposed Regulations are adopted as final regulations, consideration will be given to comments on the Proposed Regulations. Written or electronic comments must be received by 60 days after the Proposed Regulations were published in the Federal Register on December 26, 2023. A public hearing on the Proposed Regulations has been scheduled for March 25, 2024.The Treasury Department and the IRS intend to provide proposed rules addressing hydrogen production pathways that use renewable natural gas or other fugitive sources of methane (e.g., from coal mine operations) for purposes of the 45V Credit. Comments have been specifically requested on considerations with respect to such pathways.

DOE White Paper and GREET Model

The DOE also published a white paper, Assessing Lifecycle Greenhouse Gas Emissions Associated with Electricity Use for the Section 45V Clean Hydrogen Production Credit.

45VH2-GREET also is available as a user interface designed to accept input related to a hydrogen production facility, execute GREET calculations in the background, and display the well-to-gate carbon intensity of produced hydrogen in kilograms of CO2e per kilogram of hydrogen. 45VH2-GREET is currently available at https://www.energy.gov/eere/greet.