The Middle East is often considered synonymous with abundant fossil fuel reserves and its dominant role in the global market as a net exporter of oil and gas. As the world continues to make efforts to reduce its reliance on fossil fuels and accelerate the transition to a renewable or “green” energy sector, the region has played an outsized role in developing renewable energy technologies on a vast scale, primarily through its equally abundant renewable energy resources.

The Middle East benefits from its unique geographical location (being near the equator and benefiting from a jet stream), which provides an excellent opportunity for generating clean and sustainable renewable energy through solar and wind projects. The Middle East’s energy transition is taking place against the simultaneous challenge of ever-increasing energy consumption driven by digitisation, urbanisation and the advent of AI, which has driven a dramatic surge in electricity demand from data centres.

This article sets out an overview of the Middle East renewable energy market while highlighting some of the challenges and opportunities that the Middle East’s unique, and buoyant, market offers.

The Market

The Overview

For decades, the Middle East’s primary revenue stream derived from the extraction and monetisation of its fossil fuel resources; indeed, the region accounts for five of the world’s top producers of oil (Saudi Arabia, Iraq, Iran, UAE and Kuwait) and four of the world’s top natural gas producers (Iran, Qatar, Saudi Arabia, UAE).

Over the last two decades, the region has experienced sustained and rapid economic development and urbanisation which has resulted in a steep increase in energy demand that has been, and continues to be, primarily met through energy generated by the regions’ abundant fossil fuel reserves. During the same period, the region has been subjected to various geo-political challenges which have led the Middle East countries to look to diversify their economies and enthusiastically embrace the energy transition. In addition, local and global initiatives to tackle climate change (such as COP28, the Kyoto Protocol, Paris Agreement and ambitious nationally determined contributions), have driven the Middle East and its constituent states to focus on their respective energy security policies and climate goals. In recent years, the region has cemented its role as a global leader in the deployment of large utility scale renewable power projects. The steadfast support that various governmental authorities have provided to new renewable schemes in the region has undoubtedly played a key role in driving down development costs and has also acted as a catalyst for the deployment of new technologies (such as Lithium-ion Battery Energy Storage Systems and Green Hydrogen projects).

Climate Goals and Upcoming Activity

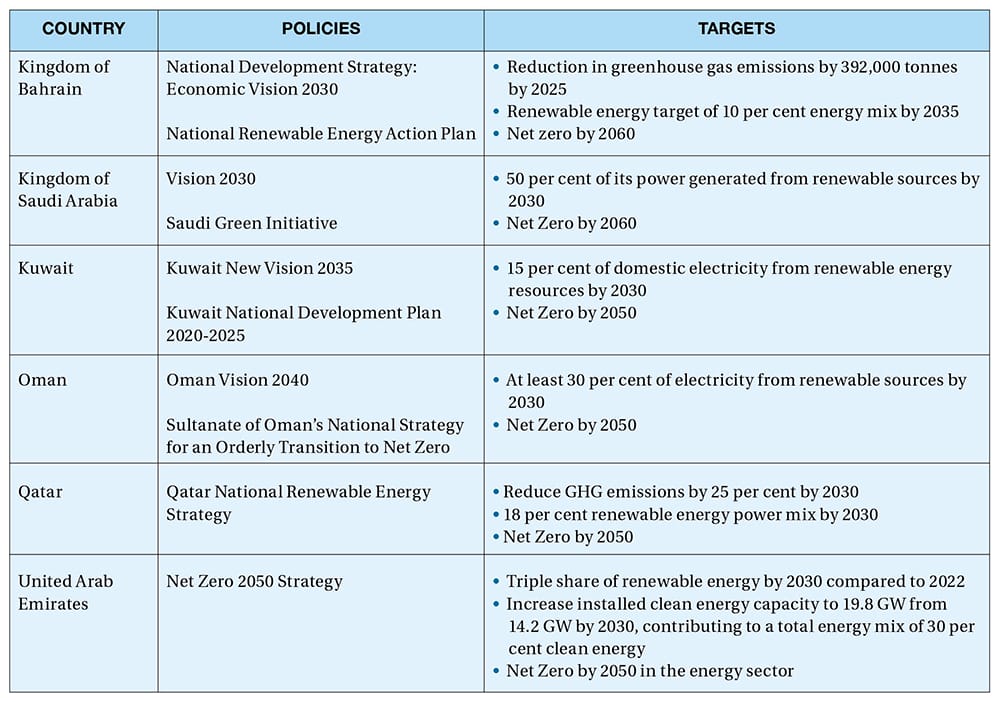

As fossil fuels produce greenhouse gases (GHGs), in recent years most Middle East governments have progressed highly ambitious plans to reduce or mitigate their GHG emissions in line with national targets set in accordance with the Paris Agreement, be it via utilising the region’s solar and wind resources, producing green hydrogen or utilising “green” resources as an energy source in the fossil fuel lifecycle (for example by way of carbon capture technologies).

For example, the UAE’s Net Zero 2050 and the Kingdom of Saudi Arabia’s Vision 2030 strategies are testaments to the region’s strong commitment towards a “net zero” future. The Kingdom of Saudi Arabia set an initial target of generating 50 per cent of its power from renewable energy by 2030 and progressed to hit a number of key milestones in 2024, including the commencement of the operation of 4 new solar plants providing 3.6 GW of energy. The Kingdom’s commitment to its Vision 2030 also enabled it to achieve the lowest global price for solar (1.04 cents / kWh) and wind (1.57 cents / kWh) energy tenders. During COP28, the UAE also demonstrated its steadfast commitment to tackling climate change (and by extension promoting renewable energy production) by providing an initial commitment of USD 30 billion to create the climate-focused investment fund, ALTÉRRA.

The table below summarises some of the Middle East’s countries’ individual reported climate change targets and associated policies.

The Middle East has long adopted a PPP model as a means of developing its power generation infrastructure, leading to a competitive and robust market for projects to be developed by private developers. The list below summarises some of the recently reported significant developments and upcoming renewable energy projects in the Middle East:

Kingdom of Bahrain

- Al Askar 100 MW IPP solar plant being developed on the Askar landfill site.

- Masdar and Bapco Energies have signed an agreement to develop up to 2 GW of offshore wind projects.

- Electricity and Water Authority has commenced a tender process for its first solar IPP scheme, the 150 MW Solar IPP project near Bilaj Al Jazayer.

Kingdom of Saudi Arabia

- Through the National Renewable Energy Program (NREP) renewable energy projects with total capacity of 19 GW have been awarded.

- SPPC has also launched a tender for grid-scale Battery Energy Storage System (G1 BESS) Projects with a total capacity of 2 GW.

Kuwait

- Kuwait Authority for Partnership Projects’ (KAPP) plans for the development of 1.1 GW Al Dibdibah Power and Al Shagaya Renewable Energy (Phase III) Zone 1 Solar PV IPP.

Oman

- At the time of writing, Nama Power and Water Procurement Company (NPWPC) have requested tenders for the development of the 500 MW Ibri III Solar IPP. This is NPWPC’s fourth solar IPP following Ibri II (became operational summer 2021), Manah I and Manah II (500 MW each, both under construction).

Qatar

- TotalEnergies, Marubeni, and Siraj Energy (a JV between QatarEnergy and QEWC) developed the 800 MW Al Kharsaah Solar PV IPP which was operational in time for the 2022 FIFA World Cup.

- Currently exploring the viability of further large-scale wind and solar projects.

United Arab Emirates

- Masdar and EWEC are developing an ‘around-the-clock’ project involving the combination of 5.2 GW of solar PV with 19 GW hours of battery storage producing continuous baseload energy of 1 GW.

- Dubai Electricity and Water Authority plans for the expansion under the IPP model of the Mohammed bin Rashid Al Maktoum Solar Park adding 1.6 to 2 GW of solar PV capacity with 1 MW BESS.

Challenges and Opportunities

In spite of the impressive resume of implemented renewable projects, as well as a multitude of planned projects to come, the region continues to confront numerous challenges to its own green revolution. For one, the increasing urbanisation of key cities, made no easier by visible migration of labour from Europe and Asia, means that the development of renewable energy is not just a question of replacing old fossil fuel assets, but also keeping up with rising demand. Of course, it is helpful that the past decade has ushered in mass production of photovoltaic solar panels, creating a previously unimaginable price compression to the development of solar farms, resulting in cost competitive electricity production (even more competitive than the fossil fuel equivalents). However, the answer to increasing demand cannot, at this time, be mass development of renewable energy only. The issue is that renewable energy still suffers from what the industry calls the “intermittency problem.” This is to say that solar farms only produce electricity when the sun shines; so too, wind farms only generate power when the wind blows. Battery systems are increasingly being co-located with these renewables farms, but at considerable cost and power loss. A utility scale battery system will at best return 70 per cent of the power that it received in charge.

This means that renewable energy, even with enormous cost reductions, cannot yet be considered for “base load” operations and is potentially expensive.

Compounding this issue, the proliferation of AI-focused data centres in the region is leading a dramatic increase in power demand, far beyond what would have otherwise been the case due to population densification alone. Studies show that the per-capita power consumption is set to increase manifold simply because of the increasing uptake of AI and digital tools, all of which consume exponentially more power than previous “information technology” infrastructure. As a result, regional governments are facing the unavoidable choice of the necessity to go back to base-load fossil fuel fired power plant solutions, just to keep up.

That said, the primary opportunity for the region remains clear – to build a greener, and more sustainable future for generations to come.

As many would agree, combating climate change is a real challenge, requiring real action. Just from the deal summaries we highlighted above, it is extremely encouraging to see so many countries in the Middle East not only setting national carbon emissions targets, but moreover aggressively pursuing those targets with tangible renewable energy developments. Most of these developments are being implemented under the so-called public-private partnership programme, leading to a sophisticated interplay between public and private interests.

Conclusion

Due to the digital transformation (e.g., AI, cloud-based services) and the increasing urbanisation and population growth in the Middle East, energy demand in the region will almost certainly continue to increase. It is clear that the region’s ambitious programme to develop huge utility scale renewable energy projects will meet some of that demand. As technologies continue to develop and familiarity continues to grow, we expect continued investment into the renewable energy space in the Middle East.