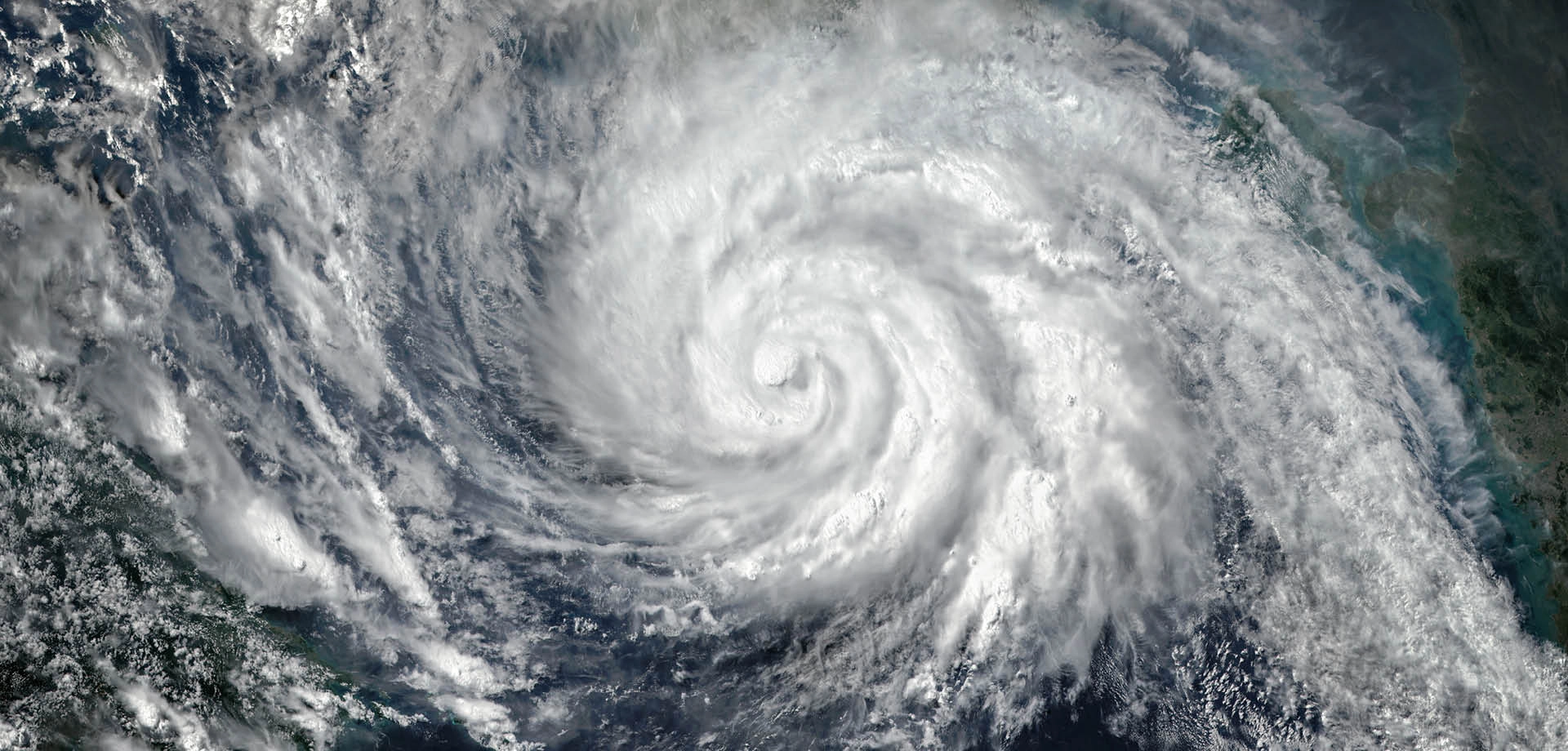

As hurricane season kicks off, ensuring your company’s insurance coverage can withstand the storm is more important than ever. Commercial property insurance policies contain numerous potential coverage pitfalls that can significantly impact a corporate policyholder’s ability to recover for losses. These challenges often remain hidden until a loss occurs, at which point they can severely restrict or even eliminate coverage for otherwise valid claims.

Understanding these common issues during the policy review process can help risk managers and legal counsel identify and address potential coverage gaps before they impact an organization.

Don’t let these hidden pitfalls and policy complexities jeopardize your operations and financial recovery. An early and thorough review of your insurance policy could mean the difference between swift recovery or devastating loss.

The Complex World of Sublimits

One of the most significant challenges in commercial property policies involves the complex structure of sublimits and their application to various types of losses. Modern commercial property policies often contain intricate networks of sublimits that can interact in unexpected ways. The relationship between different sublimits may not be immediately apparent, particularly when considering how they apply across multiple locations or to different types of losses.

The application of sublimits to time-element coverages presents additional issues to address. Business interruption claims, for example, may be subject to multiple sublimits, depending on the cause of loss and the type of interruption involved. Recognizing how these provisions interact requires careful analysis and consideration of various loss scenarios.

The Business Interruption Challenge

Business interruption coverage presents some of the most complex and potentially problematic policy language in commercial property insurance. The definition of what constitutes “suspension” of operations can vary significantly between policies and may not align with a policyholder’s expectations. Coverage may differ dramatically depending on whether an interruption is partial or complete, and the calculation of business income loss often involves complex formulas and limitations.

The treatment of extended periods of interruption deserves particular attention. Many policies contain limited periods of restoration that may not adequately account for the realities of modern business operations. The definition of when restoration begins and ends can significantly impact coverage, as can provisions relating to ordinary payroll and extra expense coverage.

Valuation Complexities

Property valuation provisions often contain hidden limitations that can dramatically impact recovery. The choice between actual cash value and replacement cost coverage involves more than simple depreciation calculations. Modern facilities often involve technological components that may be difficult or impossible to replace with identical items, raising questions about the application of functional replacement cost provisions.

Code upgrade coverage presents another area of potential concern. As building codes and regulations become more stringent, the cost of rebuilding or repairing damaged property can increase significantly. Without adequate code upgrade coverage, policyholders may face substantial uncovered costs in the event of a loss.

The Causation Conundrum

The interaction between causation requirements and exclusions also poses some of the most complex challenges in property policy interpretation. Anti-concurrent causation clauses can eliminate coverage for otherwise covered losses when excluded causes contribute to the damage. Understanding how these provisions interact with ensuing loss clauses and other coverage grants requires sophisticated analysis.

Recent events have highlighted the importance of carefully reviewing virus and contamination exclusions, as well as weather-related limitations. The application of these provisions to both direct physical loss and time element coverage can vary significantly depending on policy language and jurisdiction.

Geographic Scope and Modern Operations

Modern commercial operations often face coverage obstacles related to geographic scope and location definitions. The global nature of many businesses requires thorough consideration to territory definitions and coverage for international operations. Supply chain exposures may not be adequately addressed by traditional property policy language, particularly when considering contingent business interruption coverage.

The treatment of mobile property and newly acquired locations presents additional challenges. Policy language designed for fixed locations may not adequately address the realities of modern business operations, where property and operations frequently move between locations or expand into new territories.

Notice and Reporting: The Process Matters

The procedural requirements in property policies can create significant coverage pitfalls if not properly understood and followed. Notice provisions may require reporting of circumstances that could lead to a claim, even before a loss occurs. Documentation requirements can be extensive, and failure to comply with proof-of-loss deadlines can jeopardize coverage entirely.

Successful management of these requirements demands a systematic approach to claims handling and documentation. Organizations need clear internal procedures for identifying potential claims, gathering required documentation and ensuring timely reporting to carriers.

A Strategic Approach to Policy Review

Effective review of commercial property policy language requires more than simply reading policy terms. It demands understanding how different provisions interact and how they might apply to real-world loss scenarios. This analysis should consider the organization’s specific operations, historical loss patterns and anticipated future changes in the business.

Integration with broader risk management objectives is essential. Policy language should align with the organization’s risk assessment and tolerance, while also considering practical constraints such as market conditions and coverage availability.

Conclusion

Careful review of commercial property policy language represents a critical risk management function. Understanding common pitfalls and their potential impact allows organizations to better protect their assets and ensure coverage aligns with their needs. Regular review and updates of policy language, combined with attention to emerging risks and changing business operations, can help ensure coverage remains effective and appropriate.

Be proactive, understand your coverage intricacies, and stay prepared to face the storm.

Article was originally published by The Texas Lawbook on June 26, 2025.