Updated Texas Property Tax Incentives Program Adds New Wrinkles

Texas Gov. Greg Abbott (R) has signed HB 5 into law, enacting a new economic development incentives program that allows Texas school districts to abate property taxes in exchange for capital investment and job creation.

This new program, dubbed “Chapter 403,” replaces the former program, “Chapter 313,” which ran for 20-plus years until the legislature allowed it to sunset at the end of 2022. This article summarizes key terms of the new program, highlighting primary distinctions from the former program and foreseeable legal hurdles and considerations for new applicants.

Key Terms of Chapter 403

Beginning Jan. 1, 2024, developers may apply for a Chapter 403 agreement if they propose to construct or expand a facility related to: manufacturing, provision of utility services, dispatchable electric generation (such as non-renewable energy), development of natural resources, critical infrastructure, or R&D for high-tech equipment or technology.

Agreements under Chapter 403 will abate 100% of school district maintenance and operations property taxes during the construction period, then 50% of such taxes during the 10-year incentive period following construction, which increases to 75% if the project is built in a federal qualified opportunity zone.

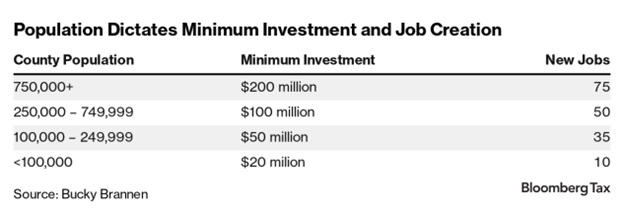

Developers must commit to certain capital investment, job creation, and wage thresholds depending on the size of the county where the project is proposed—except that electric generation facilities aren’t required to create jobs.

Chapter 403 vs. Chapter 313

The most prominent distinction between the new and former programs is the degree of economic benefit, caused by differences in both the method of tax abatement and how much goes to the school district.

Chapter 313 used a value limitation that varied based on school district size. For example, a $500 million facility might agree to pay property taxes for its first 10 years as if the facility’s value were only $30 million. Developers then negotiated to pay school districts some percentage of their tax savings—typically 10% to 50% based on complex payment formulas. Larger facilities in a competitive site-selection process that promised hundreds of jobs could negotiate lower payments to school districts as necessary to attract the project to Texas, in some cases achieving 90% tax abatement or more.

Conversely, Chapter 403 provides a one-size-fits-all 50% abatement (75% if in an opportunity zone) regardless of facility size. It also prohibits sharing tax savings with the school district, which is now entitled to only a $30,000 application fee.

While 50% abatement is similar to the tax savings typically realized by smaller, low-job creation facilities under the former program, it’s much less beneficial for mega-facilities. Local communities may struggle to attract these facilities away from other states that can bid aggressively for these projects. For example, New York recently beat out Texas to win Micron Technology Inc.’s $100 billion semiconductor facility, with something akin to a 77% property tax abatement for 49 years.

Also, developers may find it more difficult to garner necessary approvals than they did under the former program. Previously, applicants required both comptroller and school district approval. Comptroller approval was relatively straightforward, with school district approval virtually guaranteed (because of payments going back to the district).

Under new Chapter 403, applicants now also need governor approval. Further, comptroller approval may be more difficult to acquire, as applicants must show a competitive site-selection process and confirm the project won’t be built without the agreement. Perhaps most important, now that applicants can’t share tax savings with the school district, some districts have argued that they have no reason to approve agreements.

Potential Legal Hurdles and Considerations

Chapter 403 contains several provisions that will require important comptroller clarification via rulemaking in the fall of 2023. But while we await comptroller regulations, applicants may need to consider potentially significant legal issues inherent in the program:

- Timing-wise, absent substantial issues identified by the comptroller in the application process, an applicant likely will need four to six months from application to final agreement under Chapter 403.

- The statute, without elaboration, requires the applicant to execute a “performance bond” when finalizing their agreement to “protect the interests of the state.” Most applications are submitted years before construction—prior to project financing—when developers operate on lean budgets while still analyzing potential project sites. Depending on what the performance bond costs, it could greatly reduce time value benefits of the agreement and might even make applications cost-prohibitive for certain applicants.

- Applicants must now include an extensive “economic benefit statement” with their application that estimates certain project benefits to the state and local economies, which under Chapter 313 was produced by the comptroller. This economic benefit statement doesn’t appear to be particularly relevant for the comptroller’s review, but it may be useful for encouraging governor and school district approval, which are entirely discretionary.

- Finally, developers with tentative construction timing may face uncertainty as to the long-term validity of their agreement. The statute appears to require applicants to predict their construction completion date and then seek amendment if that date changes, as they always do. But both the governor and school district can veto amendments, and peculiarities in Texas school finance funding may perversely incentivize school boards to do so in bad faith.

Applicants contemplating new or expanded facilities will need to wait until Jan. 1, 2024, to submit their application. However, they can conduct numerous analyses in the meantime. Potential applicants also will be able to shape the program long-term when the comptroller’s office releases its initial draft of proposed regulations for public comment in the fall.

Article original published by Bloomberg Tax on June 22, 2023.

Skip to main content

Skip to main content