FINRA Facts and Trends: April 2024

Welcome to the latest issue of Bracewell’s FINRA Facts and Trends, a monthly newsletter devoted to condensing and digesting recent FINRA developments in the areas of enforcement, regulation and dispute resolution. This month, we report on FINRA’s first salvo against market-disrupting “FinFluencers,” a pivotal ruling that restricts who may be deemed a “customer” under FINRA rules, a new type of claim that has surged into the top 10 most common types of disputes filed in FINRA, and much more.

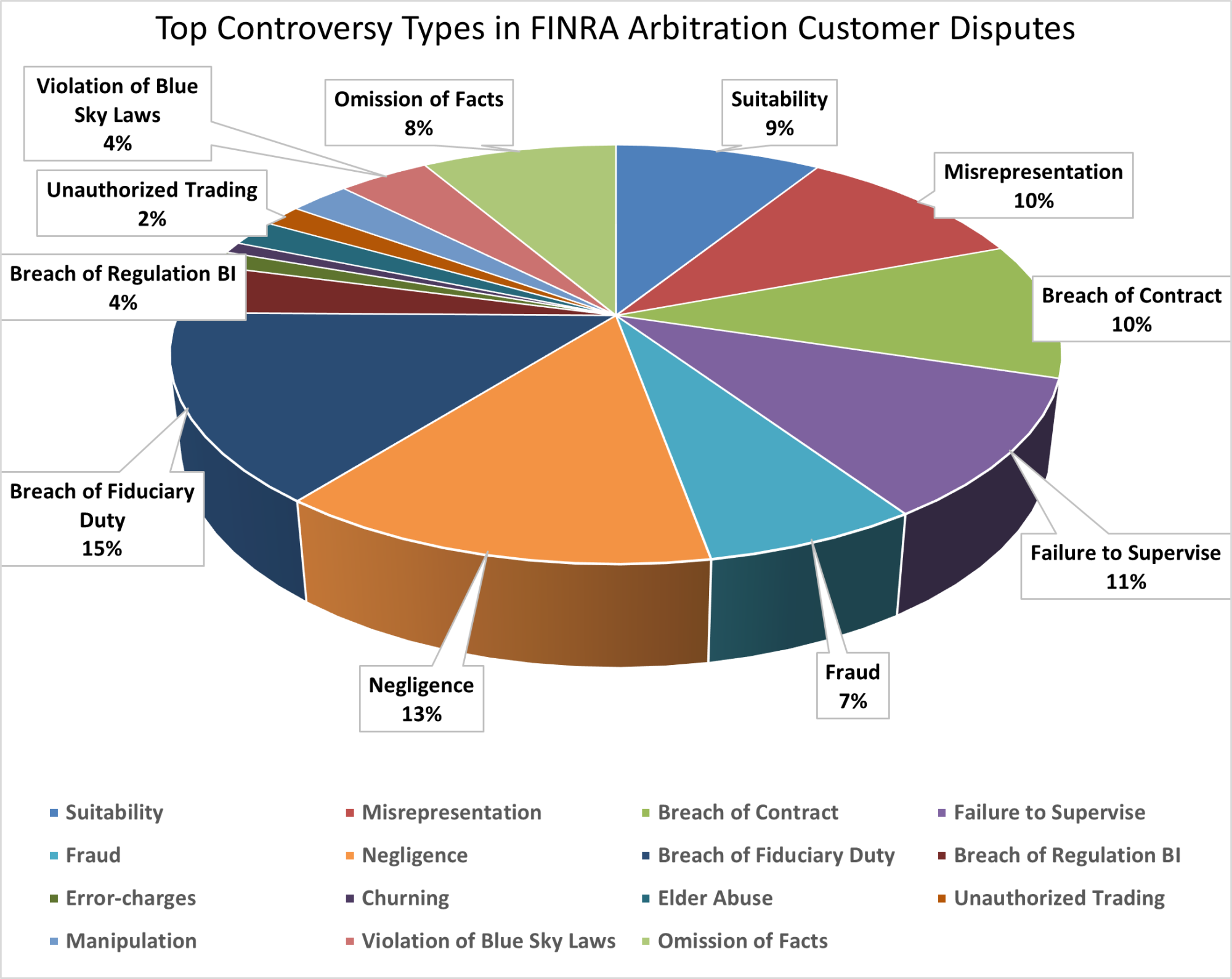

Latest FINRA Dispute Resolution Statistics Point to an Increase in Case Filings

FINRA has released its dispute resolution statistics for 2023. According to FINRA, the number of arbitration filings has increased more than 25 percent from this time last year. Customer claims have gone up 11 percent, and the number of industry disputes was 52 percent higher than in 2022.

The top five customer controversy types remain unchanged, with breach of fiduciary duty claims remaining the most frequent customer claim with a total of 1,518 cases, up from 1,340 this time last year. Notably, filings of Regulation BI arbitration claims by customers continue to rise, with 408 claims filed in 2023, compared to just 216 claims in 2022. After cracking the top 15 controversy types in May 2022, Reg BI claims are now the tenth most common controversy type (up 89 percent from last year), and the expectation is that continued Reg BI scrutiny will give rise to even more claims in 2024. The trend to initiate Reg BI claims has resulted in a related decline in the number of disputes listing suitability as the controversy type.

Source: FINRA, Dispute Resolution Statistics, https://www.finra.org/arbitration-mediation/dispute-resolution-statistics/2023 (last visited April 25, 2024).

Securities Brokerage Firm Blocks FINRA Arbitration Related to Former Broker’s Ponzi Scheme

Earlier this month, a federal judge in the Western District of Washington (in Seattle) issued a decision that not only blocked a FINRA arbitration brought against a FINRA member firm, but also clarified the bounds of who qualifies as a “customer,” as that term is used in FINRA Rule 12200.

The FINRA arbitration claims were brought by four individuals who invested and incurred losses in a private equity fund called Horizon Private Equity III LLC (Horizon). According to the court, Horizon was created and operated as a Ponzi scheme by a broker formerly associated with the FINRA member firm. The former broker pled guilty in 2023 to a single count of wire fraud and was sentenced to nearly eight years in prison earlier this year.

The federal action in Seattle was brought by the brokerage firm, seeking to enjoin the arbitration on the basis that none of the four investors had ever been customers of the firm. After full discovery, the court this month granted summary judgment in the firm’s favor.

At bottom, the court held that the investors “cannot be considered ‘customers’ under FINRA Rule 12200.” In particular, the investors “provided no evidence that they held any accounts” with the firm, as well as “no evidence that they purchased any commodity or service” from the former broker while he was associated with the firm.

As for the scope of the term “customer” for purposes of FINRA Rule 12200, the court rejected the investors’ argument that, because the former broker benefited financially from their investment in Horizon, the investors purchased their interests in Horizon from the former broker. The court held that, to the contrary, Rule 12200 “focuses on the broker’s action in facilitating the purchase, not on the entity or person who may have derived an ultimate financial benefit from the investment.”

Notable Enforcement Matters and Disciplinary Actions

- FinFluencers. FINRA’s targeted sweep to review member firms’ social media practices, which began in September 2021 and we reported upon, has borne fruit. Last month, FINRA announced the settlement of its first formal disciplinary action involving a firm’s supervision of social media financial influencers (or “FinFluencers”).

In the enforcement action, FINRA imposed an $850,000 fine on a financial services firm, alleging that social media posts made by influencers on the firm’s behalf contained exaggerated, unwarranted, promissory or misleading claims, or otherwise lacked fairness or balance. Moreover, the firm allegedly failed to review or approve the content of the social media posts. As a result, FINRA determined that the firm was in violation of FINRA Rules and the rules of the Securities Exchange Act.

Specifically, between January 2020 and April 2023, the firm allegedly paid FinFluencers to post content praising the firm, providing these promoters with graphics, literature and information they could use to spice up their posts. These materials included a “Welcome Guide” that highlighted specific services and features offered by the firm. FinFluencers were paid based on the number of new accounts opened and funded.

According to Bill St. Louis, FINRA’s Executive Vice President and Head of Enforcement: “As investors increasingly use social media to inform their financial decisions, FINRA’s rules on communicating with the public are especially critical. FINRA will continue to consider whether firms are using practices and maintaining supervisory systems that are reasonably designed to address the risks related to social media influencer programs.”

- Preservation of Communications. FINRA censured an investment banking firm and imposed a $250,000 fine for the firm’s failure to preserve and review more than 1.25 million business-related electronic communications over an eight-year period. According to FINRA, the firm’s deficient supervisory system violated Section 17(a) of the Securities Exchange Act, as well as FINRA Rules 3110, 4511 and 2010.

Allegedly, the unpreserved communications consisted predominantly of mass-marketing emails sent to distribution lists, but also included internal and external emails, instant messages and documents requiring customer signatures. Although the firm had written supervisory procedures in place, the procedures failed to specify that certain personnel had access to four communications platforms that were not subject to review or preservation.

The firm apparently discovered the flaw in its electronic communication storage and maintenance system during a compliance review.

- Violations of Reg BI and Form CRS. A financial services firm agreed to a censure and fine of $35,000 by FINRA for allegedly failing to establish and maintain a supervisory system, and failing to establish, maintain and enforce written policies and procedures, reasonably designed to achieve compliance with Reg BI. The firm also omitted required information from its Form CRS.

According to FINRA, the firm virtually ignored its Reg BI obligations since June 30, 2020, the effective date of Reg BI. The firm’s written policies and procedures contained absolutely no provisions relating to Reg BI until October 20, 2021. However, even those “updated” policies and procedures, which remained in effect until the date of the AWC, only discussed Reg BI “in general terms, without addressing Reg BI’s Conflict of Interest Obligation or establishing written policies and procedures relating to conflicts of interest, and without describing procedures for achieving compliance with Reg BI’s Care Obligation.” As to the Care Obligation, the policies and procedures did not call for registered representatives to consider costs or reasonably available alternatives when making recommendations to retail customers. As a result, the firm failed to comply with the Compliance Obligation and the Conflict of Interest Obligation, a violation of FINRA Rules 3110 and 2010.

In finding that the firm failed to comply with Form CRS, FINRA noted that since June 30, 2020, the firm omitted required information from its Form CRS. Form CRS requires certain “conversation starters” to assist potential customers in beginning a discussion with a brokerage firm about the relationship, including their services, fees, costs, conflicts and disciplinary information. Here, the firm’s initial Form CRS omitted required conversation starters and failed to include the required question, “Do you or your financial professionals have legal or disciplinary history?” Although the firm included some of this information in its updated Form CRS filed on November 1, 2021, the form continued to omit required information. Form CRS requires firms to include the following statement: “When we provide you with a recommendation, we have to act in your best interest and not put our interest ahead of yours. At the same time, the way we make money creates some conflicts with your interests. You should understand and ask us about these conflicts because they can affect the recommendations we provide you. Here are some examples to help you understand what this means.” Here, the firm did not include the entire statement or provide examples of potential conflicts of interest.

FINRA’s continued focus on Reg BI should not come as a surprise. In its 2024 Annual Regulatory Oversight Report, FINRA confirmed that Reg BI and Form CRS would remain a priority for FINRA in 2024. Additionally, in a blog post earlier this month, Bill St. Louis, FINRA’s executive vice president and head of enforcement, reiterated that his department’s “Reg BI-related disciplinary actions have been increasing.” St. Louis reminded all registered representatives and firms that FINRA maintains a helpful chart setting forth disciplinary actions that include a Reg BI or Form CRS violation.

FINRA Notices and Rule Filings

- Regulatory Notice 24-08 – FINRA has amended FINRA Rule 4210 (Margin Requirements) to create an exception under the margin rules with respect to certain short option or warrant positions on indexes that are written against products that track the same underlying index. These positions are referred to as “protected” option or warrant positions. The amendment to FINRA rules conforms with similar provisions recently adopted by the Chicago Board Options Exchange and is effective immediately.

- Trade Reporting Notice – FINRA provided advance notice of upcoming updates to its equity trade reporting guidance. Current FINRA guidance requires that, when reporting a trade for a fractional number of shares less than one, members should round up to one. FINRA is planning to implement enhancements to the FINRA Facilities to support the reporting of fractional share quantities — and upon implementation, members engaged in fractional share trading will be required to report fractional share quantities up to six digits after the decimal.

- Amendments to Codes of Arbitration Procedure – At the most recent meeting of the FINRA Board of Governors, the Board approved a rule proposal to accelerate case processing for elderly or seriously ill parties. The proposal will require SEC approval before going into effect.

Skip to main content

Skip to main content